In the bustling streets of New York, Sarah, an ambitious day trader, sipped her coffee as she debated her next big career move. With a year of retail trading under her belt, she felt confident but limited by her small capital. Across the table, her mentor, a seasoned prop trader at a leading firm, painted a picture of a different world—one filled with larger trades, access to advanced tools, and a safety net for losses. "But there’s a catch," he warned, "You’ll have to share your profits and follow strict rules." Sarah faced a question many traders grapple with: prop trading or retail trading—which path offers more opportunities while aligning with her goals?

This blog will explore the core differences, advantages, and challenges of prop trading and retail trading, equipping you to make an informed decision, just like Sarah.

What is Prop Trading?

Definition

Prop trading, short for proprietary trading, involves traders using a firm’s capital instead of their own. The firm provides funding, tools, and mentorship, while traders manage the capital to generate profits.

How It Works

Prop traders typically undergo a performance evaluation to secure a funded account. Profits are shared between the trader and the firm, while the firm absorbs losses within predefined risk limits.

Key Features

- Access to Larger Capital: Prop traders operate with significant capital provided by the firm, enabling them to take larger positions.

- Strict Risk Management Rules: Firms impose strict guidelines to protect their capital, such as drawdown limits and stop-loss requirements.

- Performance-Based Evaluation: Traders must pass challenges or meet benchmarks to qualify for funding.

70%

Statistical Insight According to a 2023 Trading Performance Survey, 70% of traders who transition to prop trading report improved performance due to better tools and access to capital.

What is Retail Trading?

Definition

Retail trading involves individuals trading with their personal funds through brokerage accounts. Retail traders make independent decisions and are fully responsible for profits and losses.

How It Works

Traders open accounts with online brokers, deposit their funds, and execute trades independently. They bear all risks and enjoy complete control over their trading strategies.

Key Features

- Complete Control: Retail traders have autonomy over their trades, strategies, and risk management.

- Flexibility: Traders can switch between strategies and instruments without external restrictions.

- Access to Tools: Modern brokerage platforms provide a range of tools, from basic charting software to advanced analytics.

20%

Fact A report by Statista indicates that retail trading accounts for approximately 20% of daily stock market volume in the U.S., demonstrating the growing participation of individual traders.

Prop Trading and Retail Trading: Key Differences

| Prop Trading | Retail Trading | |

|---|---|---|

| Capital Availability | Traders access the firm’s capital, often ranging from $50,000 to $500,000 or more. | Traders rely on personal funds, which can limit their trading volume and opportunities. |

| Profit Sharing | Profits are split, typically with traders retaining 70-90%. | Traders keep 100% of profits but bear full financial risk. |

| Risk Management | Firms enforce strict risk management rules, reducing the chances of catastrophic losses. | Traders manage their own risks, which can lead to significant losses without proper discipline. |

| Access to Resources | Offers advanced trading platforms, mentorship, and institutional-grade tools. | Access depends on the broker’s offerings, which may range from basic to premium tools. |

10x

Comparison Fact: survey by Trading Frontier revealed that prop traders leverage capital 10x higher than retail traders on average, significantly increasing their profit potential.

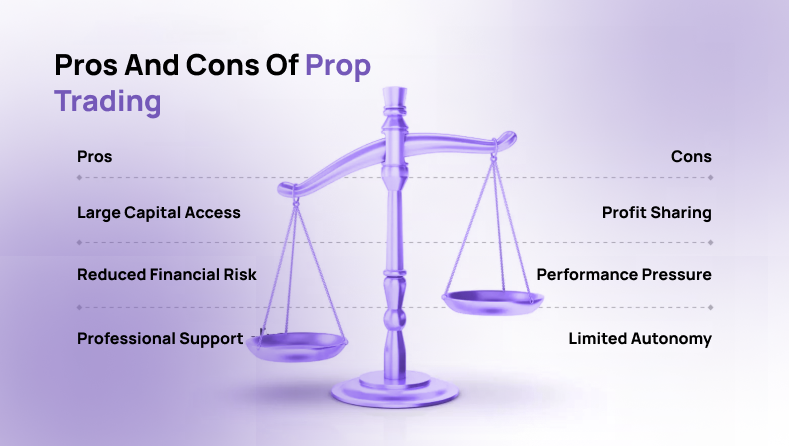

Pros and Cons of Prop Trading

| Pros | Cons |

|---|---|

|

Large Capital Access: Enables traders to take bigger positions without risking personal funds. |

Profit Sharing: Traders share profits with the firm, reducing net earnings. |

|

Reduced Financial Risk: Losses are absorbed by the firm. |

Performance Pressure: Meeting firm-imposed benchmarks can be stressful. |

|

Professional Support: Traders benefit from mentorship, advanced tools, and risk management systems. |

Limited Autonomy: Strategies and trading styles must align with the firm’s rules. |

Pros and Cons of Retail Trading

| Pros | Cons |

|---|---|

|

Full Profit Retention : Traders keep all profits from their trades. |

Profit Sharing: Traders bear 100% of the losses. |

|

Complete Independence: No external constraints on strategies or instruments. |

Performance Pressure:Retail traders often lack access to institutional-grade tools. |

|

Flexible Starting Capital: Allows traders to start small and scale up gradually. |

Limited Autonomy: Trading volume is limited by personal funds. |

Choosing the Right Path for You

The choice between prop trading and retail trading depends on your goals, experience, and risk tolerance:

- Choose Prop Trading If:

- You want access to significant capital.

- You value mentorship and professional support.

- You prefer reduced personal financial risk.

- Choose Retail Trading If:

- You value autonomy and flexibility.

- You want to retain all profits.

- You are comfortable managing your own risks and funds.

Pro Tip :

Many traders start with retail trading to gain experience and transition to prop trading for larger opportunities.

Risks of Retail Trading vs. Prop Trading

- Retail Trading

- High risk of losing personal funds.

- Requires self-discipline and extensive market knowledge.

- Choose Retail Trading If:

- Performance pressure and strict rules.

- Profit-sharing reduces overall earnings.

80%

Fact : Research by Modest Money indicates that 80% of retail traders lose money in their first year due to inadequate risk management.

Conclusion

Prop trading and retail trading offer unique advantages and Prop Trading challenges. Prop trading provides access to larger capital, professional tools, and reduced financial risk, making it ideal for traders aiming to scale up. Retail trading, on the other hand, offers full autonomy and profit retention but demands higher personal risk and discipline.

By understanding your trading goals, risk appetite, and resource needs, you can choose the path that best aligns with your ambitions. Like Sarah, the right decision could pave the way for your success in the dynamic world of trading.