A Guide to Navigating and Avoiding Pitfalls in Proprietary Trading

Proprietary trading offers traders the opportunity to leverage firm capital, providing a platform for significant potential profit. However, even the most skilled prop traders encounter challenges, often resulting from common mistakes that hinder success. This article explores frequent prop trading mistakes and provides actionable strategies to help traders avoid these pitfalls.

Trading Without a Plan

One of the most fundamental errors that prop traders make is trading without a structured plan. A trading plan is the backbone of disciplined trading, providing a roadmap for setting goals, defining risk tolerance, and establishing entry and exit points. Without a plan, traders may make impulsive decisions, often leading to inconsistent results and avoidable losses. Developing a clear, actionable plan can help prop traders stay focused and maintain discipline during volatile market conditions.

Tip

Define your trading plan based on specific goals, a clear strategy, and predefined risk management rules. Regularly review and adapt your plan to stay aligned with your long-term objectives.

Letting Profitable Trades Turn Into Losses

Allowing a profitable trade to turn into a loss is a common error among prop traders. This often happens when traders hold out for higher profits, ignoring their exit strategies. Instead, they watch the trade reverse, eating into profits or turning into losses. By setting realistic profit targets and adhering to exit rules, traders can secure gains and avoid unnecessary risk.

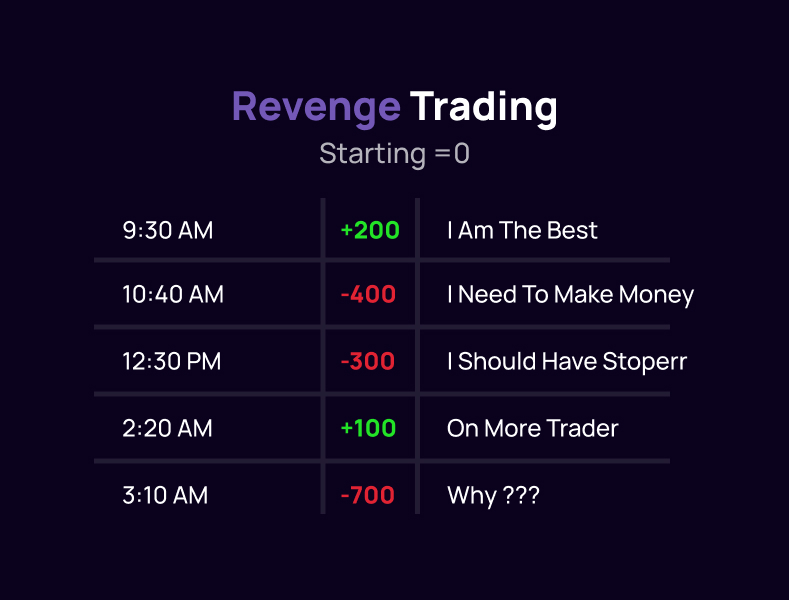

Revenge Trading

Revenge trading refers to the practice of taking impulsive trades to recover from a recent loss. This emotional response often exacerbates the loss, as traders make decisions out of frustration rather than strategic analysis. Revenge trading is a recipe for escalating losses and often leads to regret.

Advice

When experiencing a loss, step back to reassess and wait until you are calm before making your next trading decision. This prevents emotionally driven trading and helps maintain discipline.

Overexposing a Position

Overexposure occurs when traders risk too much capital in a single trade. This increases the chances of significant loss if the trade does not go as planned. It is crucial to diversify and limit exposure on any single trade, especially in volatile markets like forex.

Example

A prop trader who risks 20% of their capital on a single forex position is overexposed. By spreading out trades, they can manage losses more effectively and prevent account depletion from a single trade misstep.

Overtrading

Prop traders may fall into the trap of overtrading due to market excitement or a desire to make quick profits. However, frequent trades don’t guarantee higher returns and often result in excessive losses due to transaction costs and poor trade quality. By focusing on quality over quantity, traders can achieve more consistent results.

Being Able to Accept Losses

Accepting losses is part of being a disciplined trader. Refusing to close a losing trade in hopes of a reversal can lead to greater losses. Recognizing when a trade has failed and having the courage to exit is essential for long-term success. Losses are natural; the key is managing them effectively.

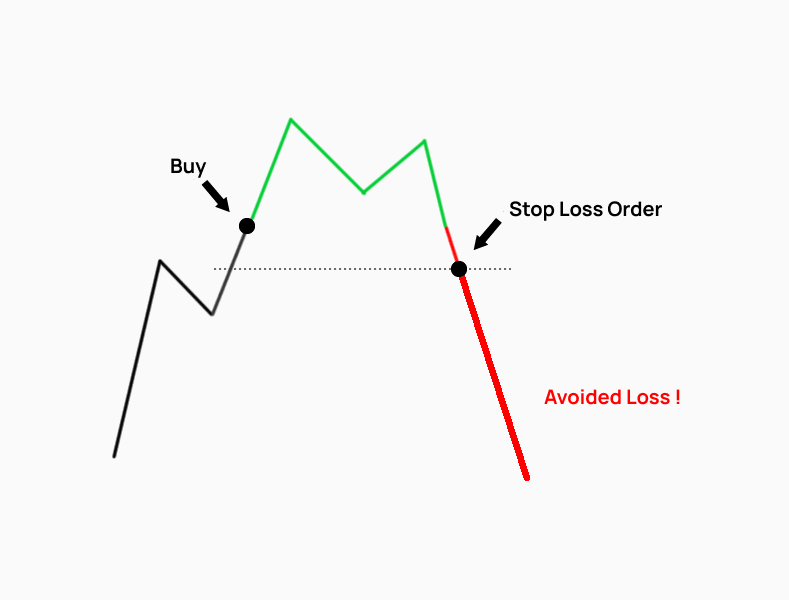

Not Using a Stop-Loss Order

A stop-loss order is one of the most critical tools for risk management, and failing to use it is a costly mistake. Without a stop-loss, traders leave their positions vulnerable to substantial losses, especially during volatile market shifts. Setting stop-losses can help traders define their risk upfront and avoid catastrophic losses.

Statistical Insight

According to market studies, traders who consistently use stop-loss orders tend to outperform those who do not, as stop-losses prevent prolonged loss exposure.

Chasing Markets with Strong Performance

When traders chase high-performing markets, they often jump into trades based on recent price action rather than sound analysis. This can lead to poor entry points and increased risk, especially if the market experiences a correction. Rather than following recent trends, traders should base trades on thorough analysis and their predefined strategies.

Not Understanding the Risk-to-Reward Ratio

The risk-to-reward ratio is a foundational concept in trading, indicating the potential reward relative to the risk taken on each trade. Not understanding or miscalculating this ratio can lead to losses that outweigh potential gains. A general rule is to target trades where the reward is at least twice the risk, helping ensure that profitable trades cover the cost of losses.

Risking More Than You Can Afford

One of the cardinal rules of trading is never to risk more than you can afford to lose. Prop traders often face the temptation of betting big to maximize returns, but this can lead to devastating losses. Proper risk management entails setting realistic limits on each trade based on the capital available, ensuring traders can recover from a loss without jeopardizing their position in the market.

Emotional Trading

Emotional trading is a widespread issue, especially among newer traders. Emotions such as fear, greed, and impatience often cloud judgment, resulting in poor decision-making. Developing emotional discipline by sticking to a trading plan and practicing mindfulness can reduce the negative impact of emotions on trading outcomes.

Ignoring Compliance and Regulatory Requirements

Prop trading firms operate within regulatory frameworks, and ignoring compliance and regulatory requirements can lead to penalties and, in severe cases, legal consequences. It is vital for traders to understand and adhere to the regulatory guidelines of the markets they trade in, ensuring they remain compliant with firm policies and regional laws.

Over-Leveraging

Leverage can amplify both gains and losses, and over-leveraging is a common mistake among prop traders. Using excessive leverage increases exposure to market fluctuations, leading to potential losses that outweigh capital. A disciplined approach to leverage usage is essential, especially in highly volatile markets.

Exiting Winning Trades Too Early

Prematurely exiting winning trades is often a result of fear or impatience. By setting specific profit targets and adhering to a strategy, traders can maximize gains without cutting their trades short. Proper planning and clear exit criteria help traders manage winning trades effectively.

Example

A trader who sets a profit target but exits after a small profit misses out on potential gains. Following a strategy allows traders to capture more value from winning trades.

Trading in Multiple Markets at Once

For beginners, trading in multiple markets simultaneously can lead to confusion, divided attention, and mistakes. Each market has unique characteristics, and understanding these subtleties requires focused attention. Prop traders are encouraged to start with one market and become proficient before expanding into others.

The Bottom Line

Prop trading is an exciting yet challenging field that offers traders the chance to trade with greater capital and potentially earn substantial returns. However, it comes with pitfalls that can derail even the most skilled traders. By recognizing and addressing common mistakes, such as overexposure, emotional trading, and lack of planning, traders can enhance their success and achieve long-term growth. Mastery in prop trading requires discipline, emotional control, and a strong understanding of risk management—qualities that set successful traders apart from the rest.

Frequently Asked Questions

-

What is the main advantage of being a prop trader over an individual trader?

- The primary advantage of prop trading is access to a larger capital base, allowing traders to trade bigger positions without risking personal funds. Prop traders also benefit from firm resources, such as advanced tools, research, and structured mentorship.

-

How does the compensation structure for prop traders typically work?

- Prop traders generally operate on a profit-sharing model, where they earn a percentage of profits generated. Compensation structures vary, but traders can expect a portion of profits, with firms retaining a share to cover operational costs and risks.

-

What kind of support can prop traders expect from their firm?

- Prop trading firms often provide resources, including educational materials, advanced trading platforms, risk management tools, and mentoring, to help traders succeed.

-

What skills are essential for a successful prop trader?

- Key skills include discipline, strong risk management, emotional control, and a solid understanding of market analysis. Successful prop traders are also adaptable and able to follow firm-imposed trading rules and guidelines.